Blog

Don’t Leave Money Behind: Finding Your Missing 401(k)s

You've worked hard throughout your life to build assets to support your retirement. As financial professionals, one of the most critical functions we provide is helping clients determine their retirement income needs and structuring a...

Read MoreTax Season Brings a New Wave of Identity Theft Risks

Tax season brings a new wave of identity theft risks, with criminals ready to exploit your personal data to file fraudulent tax returns in your name. Imagine the shock of discovering that a criminal beat you to filing your...

Read More10 Facts You May Not Know About Social Security

Social Security is often misunderstood or underestimated in retirement strategy. However, as financial professionals, we've seen how it can play a crucial role in our clients' overall financial strategy, regardless of their income...

Read MoreInnovative New Year's Resolutions: Financial and Personal Growth Strategies for 2025

Looks like New Year's resolutions are still going strong in 2025! A recent Pew survey found that about a third of Americans kicked off the year with at least one resolution, and many people actually went for multiple goals. It's...

Read MoreKey Financial Insights from 2024 and Looking Ahead to 2025

As we approach the end of 2024, it's an opportune time to reflect on the year's financial developments and consider what 2025 may bring. We believe in understanding both the past and potential future of our economic landscape, which...

Read MoreShow All

Navigating Healthcare Costs in Retirement: Life After Employer-Sponsored Health Insurance

As you approach retirement, a critical aspect of your retirement strategy can catch even the most financially savvy individuals off guard: healthcare costs. For decades, you may have enjoyed employer-sponsored health insurance. As...

Read MoreA Different Kind of Year-End Review: 10 Steps to Reflect and Recharge

Financial professionals typically have a year-round focus on monetary goals and wealth management strategies. However, we also believe that true financial well-being is intrinsically linked to your overall life satisfaction and...

Read MoreYear-End Giving Strategies: Maximizing Your Impact

America is a generous country. People with diverse backgrounds can unite for a good cause, whether to benefit their local communities or the broader world. As we enter the holiday season, now is a great time to think about your giving...

Read MoreExploring the Financial Impact of Electric Vehicles

As financial professionals, we’ve noticed a trend among our clients: an increasing interest in electric vehicles (EVs). To help address some of your questions, we’ve compiled this high-level guide to provide insights into the...

Read MoreSafeguarding Your Identity: Essential Tips for Financial Security

Statistics show that nearly 33% of Americans have faced some identity theft attempts in their lives, and experts estimate there is a new case of identity theft every 22 seconds. As financial professionals, one of our primary goals is...

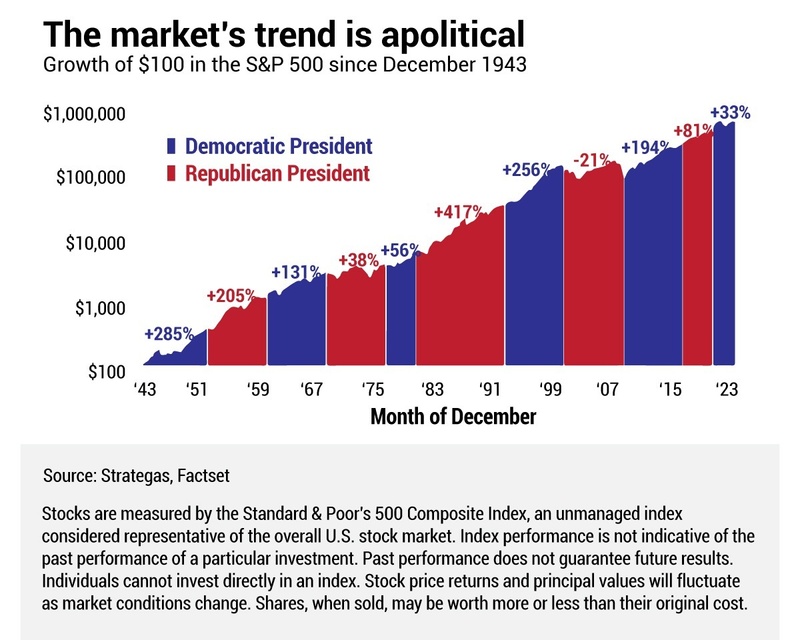

Read MoreThe Impact of Elections on the Markets and Tax Policy

The Impact of Elections on the Markets and Tax Policy With Labor Day behind us, we're in the final stretch of the 2024 presidential election race. As we follow the news and parse the most recent polls, some may ask, "How might what...

Read MoreDon’t Be A Victim Of The Retirement Crisis

Don’t Be A Victim Of The Retirement Crisis If you think the United States has a retirement crisis, you are not alone. A recent survey found that 79% of working-age Americans believe the same thing. That percentage is up from 67% in...

Read MoreUnderstanding Volatility and the Benefits of a Long-term Investing Strategy

Investors typically include equities in their long-term plans with the expectation of generating a positive return. Historically, over longer periods of time, this strategy has helped many investors achieve their desired goals. While...

Read MoreArtificial Intelligence’s Influence on the Investing Landscape

In 1999, Bill Gates wrote, “How you gather, manage, and use information will determine whether you win or lose.” Companies looking to be successful in the future should heed these words when making decisions about implementing...

Read MorePreparing to Send a Child Off to College? Don't Forget These Important Topics

Sending a child off to college is a major milestone for any family, whether you’re a parent, grandparent, or close friend. It’s an exciting time, filled with anticipation and perhaps a bit of trepidation. There’s so much to do, and...

Read MoreQuarterly Economic Update Second Quarter 2024

Equity and bond markets began the second quarter of 2024 with a rough start, thanks to the Federal Reserve’s decision not to reduce interest rates due to stubbornly high inflation rates. However, during the quarter, strong performances...

Read MoreCommon Investing Mistakes to Avoid

Whether someone has $50,000 or $5,000,000 to invest, there are several investment pitfalls that any investor can fall into. One of our goals as financial professionals is to help clients avoid these pitfalls, which could be very costly...

Read MoreUsing ROTH and Traditional IRAs as Strategies for Building Your Retirement in 2024

Everyone saving for retirement knows being proactive is very important. Having healthy retirement savings can help you live comfortably in your golden years. As stewards of our clients’ wealth, we get great satisfaction helping parents...

Read MoreQuarterly Economic Update First Quarter 2024

The first quarter of 2024 continued to reward investors who stayed the course and enjoyed strong returns in 2023 as the momentum of 2023’s year-end rally took another step forward. Both equity and bond markets performed well after the...

Read MoreProactive Planning for the Upcoming Sunset of Estate Tax Law Changes

Communication and planning have always been essential when attempting to transfer wealth efficiently. Tax planning can also play a significant role for larger estates. Currently, the federal estate tax laws are very generous, however,...

Read MoreHelpful Information for Filing 2023 Income Taxes and Proactive Tax Planning for 2024

Income tax is a large revenue source for the United States government. While tax rates have changed many times, since the 1860’s, the United States has used a “progressive” tax code. A progressive tax code...

Read MoreQuarterly Economic Update Fourth Quarter 2023

2023 is in the books and the last quarter left investors looking forward to a bright and happy new year. Historically, equities typically have advanced in the fourth quarter, and we can now add 2023 to that statistic. We entered the...

Read MoreCan Money Determine Your Happiness?

In 1964, Paul McCartney and John Lennon of the Beatles co-wrote the hit song “Money Can’t Buy Me Love” but, could it bring you happiness? In 2010, Princeton University conducted a study which found that day-to-day...

Read MoreProactive Year-end Tax Planning for 2023 and Beyond

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing...

Read MoreFive Strategies To Improve Your Investing Experience

There are numerous investment philosophies, but at the end of the day, almost all investors have a common goal – to have their money work for them and increase their assets.As financial professionals, our goal is to partner with...

Read MoreIdeas to Help Prepare for a Recession

For the last several months, talk of a recession has been making news headlines. Analysts and investors have been speculating if, when, and how bad of a recession the U.S. could experience. News sources have resembled Paul Revere...

Read MoreQuarterly Economic Update First Quarter 2023

The first quarter of 2023 had investors sitting on the edge of their seats as the equity markets took them for a bumpy ride. In the end, the quarter did close on a good note, with U.S. stocks having a late quarter comeback following...

Read MoreWeathering Volatility With a Long-term Strategy

Read the financial news today and it’s highly likely you’ll see the term “volatility” in at least several articles. While market volatility is a normal part of the investing experience, ever since the pandemic...

Read MoreHelpful Information for Filing 2022 Income Taxes and Proactive Tax Planning for 2023

Helpful Information for Filing 2022 Income Taxes and Proactive Tax Planning for 2023

Read MoreQuarterly Economic Update Fourth Quarter 2022

It’s probably a fair assumption to say that most investors are happy 2022 is in the books. After enjoying the longest bull market in history, from after the financial crisis in 2009 to the beginning of the COVID-19 pandemic...

Read MoreWelcome to 2023!

Happy New Year and welcome to 2023! We hope that you and your family had an enjoyable holiday season. We look forward to what this new year has to offer.2022 was rough for investors, with many of the year’s events...

Read MoreGoing Back to Basics: Time to Review Some Important Financial Fundamentals

“May you live in interesting times,” is an expression where someone ironically wishes an “interesting” time to whomever they are speaking with. Although it may seem innocuous it’s really an insult...

Read MoreProactive Year-end Tax Planning for 2022 and Beyond

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing...

Read MoreFoundational Information That Successful Investors and Savers Understand!

Like many other savers and investors, you may be worried that we are headed toward more challenging economic times. Successful savers and investors are usually more prepared to handle difficult financial periods because...

Read MoreQuarterly Economic Update - Second Quarter 2022

The first half of 2022 has been a nightmare for even the most seasoned of investors. When looking back, from the March 2020 lows until January 2022, investors were treated to a 21-month bull market that saw equity markets more than...

Read MoreMarket Downturns: Uncomfortable But Not Uncommon

Market Downturns, Volatility, Investing, Investors, Risk Tolerance, Time Horizon, Financial Planning, Retirement Planning

Read MoreHelpful Information for Filing 2021 Income Taxes and Proactive Tax Planning for 2022

Read More

Proactive Year-end Tax Planning for 2021 and Beyond - Including Key Tax Change Proposals

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing...

Read MoreAnticipating Rising Interest Rates

Interest rates play a crucial role in the American economic system. They influence the return on savings, the costs of borrowing and can have a bearing on the direction of many investments. The direction of interest rates is also known...

Read MoreFocusing on Factors You CAN Control

Every investor normally has personal goals in mind that they would like to achieve. Although most non-retired adults have some savings, only 36% say their nest egg is “on track,” according to the Federal Reserve. Sometimes,...

Read MoreQuarterly Economic Newsletter - Quarter 2 2021

In the first half of 2021, investors welcomed a new administration in the United States of America, saw the reopening of many countries, experienced volatility in equity markets and ended a second quarter that produced many new highs....

Read MoreMarket Volatility: A Part of the Investment Experience

Market volatility is a part of the investment experience and seasoned investors understand that acting emotionally can be more harmful than helpful. It is always appropriate to understand and prepare for market volatility and downturns...

Read MoreProactive Tax Planning, Because Taxes Matter!

In the beginning, there were no income taxes or federal government. Newly organized individual colonies made ends meet by taxing a variety of things other than income, such as occupational taxes and excise taxes on specific goods....

Read MoreQuarterly Economic Update - Quarter 1 2021

What a difference a year makes. The first quarter of 2021 included the one-year anniversary from the March 2020 equity market’s bottom. For the first quarter of 2021, equity markets encountered volatility but still created...

Read MoreTraditional and ROTH IRAs - Strategies for Building Your Retirement

It is extremely important that we all take our retirement into our own hands. The concept of not preparing and relying on a government-sponsored retirement might not be the best plan. Financial woes combined with the fact that the U.S....

Read MoreHelpful Information for Filing 2020 Income Taxes and Proactive Tax Planning for 2021

Helpful Information for Filing 2020 Income Taxes and Proactive Tax Planning for 2021 Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to point...

Read MoreHow the Internet Gamed Wall Street’s Short Sellers

You may have heard the news about stocks for certain companies suddenly ballooning, quickly going from lunch money prices to several hundred dollars a share. In one case, the shares rose over 1700% since December 2020.1 So, what...

Read MoreQuarterly Economic Newsletter - Quarter 4 2020

There are many years that history could easily forget, but 2020 certainly will not be among them. The past year challenged us in more ways than we were prepared for and the thoughts of a “Happy New Year” seemed to be more...

Read MoreWelcome to 2021

Welcome to 2021! We hope that you and your family had an enjoyable holiday season. Last year presented some of the most challenging times for everyone and we are hoping that a new year will bring better results. We appreciate the...

Read MoreProactive Year-end Tax Planning for 2020 and Beyond

One of our main goals as holistic financial professionals is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing...

Read MoreLow Interest Rates and Investors

Interest rates are important to investors and they are currently at or near all-time lows. At this past June’s Federal Reserve meeting, interest rates were kept at a range of 0%-0.25% and it was indicated that they will remain...

Read MoreQuarterly Economic Update - Q2 2020

After a sharp waterfall drop in March, major equity markets advanced strong in the second quarter. Following the Dow Jones Industrial Average's (DJIA) worst first quarter ever, the index posted its best second quarter performance...

Read MoreProactive Retirement Planning Using the New SECURE Act

On December 20, 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law. This new legislation made major changes to a number of tax rules that govern retirement savings. Many of these changes...

Read MoreTraditional and ROTH IRAs - Taking Retirement Into Your Own Hands

It is extremely important that we all take our retirement into our own hands. The concept of not preparing and relying on a government-sponsored retirement might not be the best plan. Financial woes combined with the fact that the U.S....

Read MoreQuarterly Economic Update - Q1 2020

No one expected the longest bull market in history to see its demise brought on by a virus. While U.S. equity markets were able to withstand a trade war with China, a presidential impeachment, the potential for a global recession and...

Read MoreA Quick Look at Recessions and Market Crashes

After an 11-year bull market, the longest in history, equity markets have entered into bear market territory. A bear market is defined as a downward move of 20% from a recent high and as of today all three major US indexes (DJIA, S&P...

Read MoreMarket Volatility Update: Markets Go Up and Markets Go Down

The last few days of February created confusing and turbulent times for investors. The rough stock market fluctuations created a rollercoaster-type of ride that has attracted almost every media outlet. During this time period, the S&P...

Read MoreThe Market Sell-Off and Coronavirus: An Investor’s Perspective

Investors have now experienced their first disruption of the year: The Coronavirus. The investing experience is no stranger to unexpected surprises and on Monday, February 24th, all three major equity indexes fell over 3%. The -3.35%...

Read MoreTax Report - Q1 2020

Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to point out as many tax savings opportunities and strategies as possible for our clients. This...

Read MoreQuarter 4 Newsletter - 2019

As we look back and reflect on what was predicted by many to be a year of worry and concern, equity markets advanced heavily in 2019 and investors were rewarded. The final month of the year brought several new highs for both the S&P...

Read MoreYear End Tax Planning - 2019

One of our main goals as holistic financial advisors is to help our clients recognize tax reduction opportunities within their investment portfolios and overall financial planning strategies. Staying current on the ever-changing tax...

Read MoreQuarter 3 Newsletter - 2019

After some concerns and declines during the summer, major equity markets showed advances in the month of September and finished positive for the third quarter of 2019. The S&P 500 ended the month about 1.7% higher, and up by 1.2% for...

Read MorePlanning for Your Retirement

Retirement! Most Americans get excited about the day they no longer have to go to work to earn an income. No more bosses, no more meetings to attend, no more schedules to keep, no more stress that even the best of jobs can create....

Read MoreStrategies for Investors in a Volatile Market

During volatile times, many investors get agitated and begin to question their fundamental investment decisions and choices. This is especially true for those investors who monitor their portfolios daily and can be tempted to pull out...

Read MoreQuarter 2 Newsletter - 2019

The first half of 2019 brought very strong results for financial markets. Both equity and bond investors saw positive results leaving investors in a happy mood. The Dow Jones Industrial Average (DJIA) enjoyed its largest June gain...

Read MoreThe new SECURE Act and Proactive Retirement Planning

The House of Representatives passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act on May 23. The next step is to pass through the Senate and be signed by the President. With strong bipartisan support and the...

Read MoreQuarter 1 Newsletter - 2019

During the first three months of 2019, investors had a lot to cheer about as U. S. equity markets turned in their best quarterly gains in nearly a decade. This helped many of the major indexes to recoup a good portion of the losses...

Read MoreHelpful Information for Filing 2018 Income Taxes and Proactive Tax Planning for 2019

Tax planning should always be a key focus when reviewing your personal financial situation. One of our goals as financial professionals is to point out as many tax savings opportunities and strategies as possible for our clients. This...

Read More