After an 11-year bull market, the longest in history, equity markets have entered into bear market territory. A bear market is defined as a downward move of 20% from a recent high and as of today all three major US indexes (DJIA, S&P 500, and NASDAQ) have reached those levels. Currently, there is talk of the possibility that we are headed toward or already started a recession for the first time since 2007-2009.

As every news source is reporting, the Coronavirus (COVID-19) is serious and has created an environment of slower business for many companies and industries. The travel industry is severely impacted and many large events are shut down. Large groups of people are advised to stay home, many schools have been closed down, employees have been instructed to work from home and some companies are now operating remotely. This pandemic is testing our healthcare capabilities and reports suggest this could continue for quite some time.

In the global economy and throughout financial markets we are experiencing a level of fear that we have not had to worry about for over a decade. Heavy stock market downturns can and have happened for any number of reasons but recessionary periods have been connected to some of the worst market declines in history.

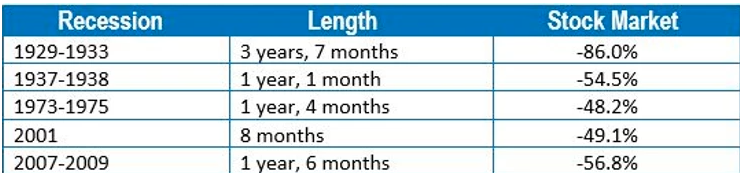

There are five declines during recessions when the stock market went down almost 50% or more.

Sadly, the recency bias of the Great Recession of 2007-2009 might not be helpful for investors now. Even after that experience, patience and not panic was rewarded for many long-term investors. A recession is not always a devastating prolonged experience.

Another key fact to remember is that market crashes are not always from a recession. The famous 1987 Crash didn’t have anything to do with an economic recession. While recessions are not common and are highly disruptive to long term investors, they are not unicorns.

Since we are discussing recessions, here is a chronological list of 14 recessions since 1929:

In February of 2020, equity markets made all-time highs. Long-term patient investors can recover from downturns. As of mid-day March 12th, the current downturn of the stock market is actually worse than several of the overall period downturns on the chart.

Most investors are thinking, can this get worse? Obviously, no one can answer that question with precision. We are facing a pandemic that is very serious and as of now has not been solved. Trying to match your equity positions with recession numbers and future guesses of medical solutions is impossible.

So, what can you do?

This might be repetitive, but first and foremost, continue to ask yourself four questions:

- Have my financial timelines changed?

- Have my financial goals changed?

- Has my risk tolerance changed?

- Is my advisor aware of my situation?

Regardless of whether or not equities are rising or falling, investors should always put their main focus on their own personal objectives. This might also be a good time to avoid media magnification.

If your portfolio is based on your situation, then this might be a good time to remember the sage advise of the late iconic investor Sir John Templeton, “Success in the stock market is based on the principle of buying low and selling high.”

While we are not clairvoyant, we are here for you. Our goal is to be prepared, not scared! If you feel we need to talk, please call. We are honored that you have chosen us to help with your financial needs.

Very Truly Yours,

Capital Income Advisors

___________________________________________________________________________

Disclosures:

Securities offered through Securities America, Inc., Member FINRA/SIPC. Advisory services offered through Arbor Point Advisors LLC. Capital Income Advisors, Securities America, Inc., and Arbor Point Advisors LLC are separate entities.

Note: The views stated in this letter are not necessarily the opinion of Securities America and should not be construed, directly or indirectly, as an offer to buy or sell any securities mentioned herein. Investors should be aware that there are risks inherent in all investments, such as fluctuations in investment principal. With any investment vehicle, past performance is not a guarantee of future results. All indices referenced are unmanaged and cannot be invested into directly. The S&P 500 is an unmanaged index of 500 widely held stocks that is general considered representative of the U.S. Stock market. Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. Past performance is no guarantee of future results Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. No article should ever be considered to be advice, research or an invitation to buy or sell any securities.

Sources: A Wealth of Common Sense 3/11/2020, © The Academy of Preferred Financial Advisors.